Fraud analysis

Shopify’s fraud analysis helps you identify orders that could be fraudulent. Review high-risk orders to avoid potential chargebacks. Fulfilling high risk orders can result in a higher number of chargebacks and that can result in disabling payment processing and removal from Shopify Payments.

Credit card companies can reverse funds for stolen cards after orders are fulfilled. Shopify helps you to gather evidence for any disputed charges. However, the decision to reverse funds is made by the bank that issued the credit card, not by Shopify. Shopify does not cover charge reversals from banks.

Fraud analysis is designed to work with online credit card orders, when Shopify can verify the payment. This means that some types of orders, including those that are processed offline, don’t receive recommendations.

If your store is on the Basic Shopify plan and you don't have Shopify Payments, then fraud analysis includes the following:

- indicators

- support for third-party fraud apps.

If your store is on the Shopify plan or higher, or you have Shopify Payments on any plan, then fraud analysis includes the following:

- indicators

- support for third-party fraud apps

- fraud recommendations.

On this page

Fraud analysis indicators

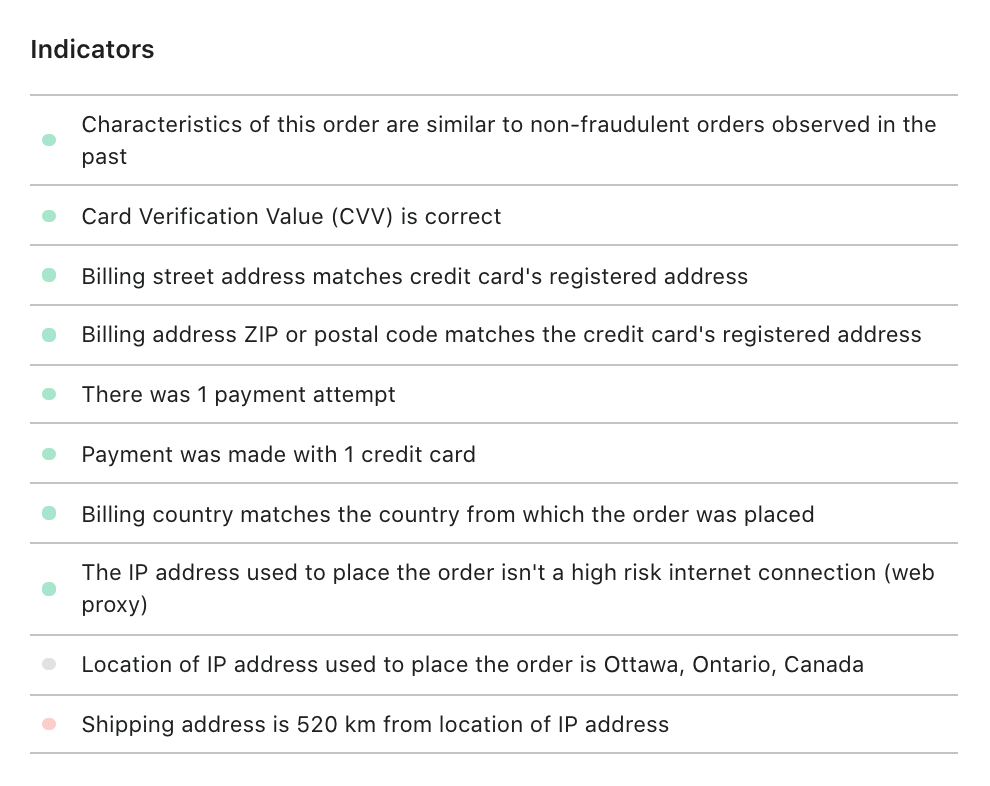

Shopify's fraud analysis provides indicators for each order. The indicators can be used to investigate an order that you think might be fraudulent. The indicators can include information such as:

- whether the credit card used for the order passes AVS checks

- whether the customer provided the correct CVV code

- details about the IP address used to place the order

- whether the customer tried to use more than one credit card.

The full analysis for an order lists all the indicators. These indicators are marked with green, red, or grey icons to help you highlight different behaviour types.

Green indicators show information about the order that is usually seen on legitimate orders. Red indicators show information about the order that is usually seen on fraudulent orders. Grey indicators give you additional information about the order that could be useful.

Indicators can give you ideas about how to investigate an order, but they don't show you how likely it is that an order is fraudulent. If you want to know how likely an order is to be fraudulent, then you should look at the order's fraud recommendation.

Third-party fraud apps

You can download apps that help with fraud prevention from the Shopify App Store. Indicators and recommendations from these apps show up with Shopify's fraud analysis for each order.

Fraud recommendations

Fraud analysis gives you a fraud recommendation on all online credit card orders.

The fraud recommendation tells you if an order has a low, medium, or high risk of a chargeback due to fraud. If an order has a medium or a high risk, then it's flagged on the Orders page with a warning symbol next to the order number.

Flagged orders are also brought to your attention in order notification emails if you subscribe to them.

Fraud recommendations are powered by machine learning algorithms that are trained on historical transactions across all Shopify stores. The recommendations give you the benefit of years of fraud detection experience. Shopify continuously improves these algorithms to better identify fraudulent orders.

If an order is at a high risk of fraud, then you can attempt to verify the order, cancel the order, or refund the order.

View the fraud analysis for an order

Fraud analysis pending

Fraud analysis typically happens immediately, but in rare cases the process can take a few minutes. If you see a message in an order stating that fraud analysis isn't available yet, then you can try refreshing the page or check back in a few minutes. It's a good idea to wait for the fraud analysis to finish before you fulfill the order.

Testing fraud analysis

To test fraud analysis on your store you can use the following email addresses to simulate a high, medium, or low risk order.

- shopify.test.high@shopify.com to create high-risk recommendations

- shopify.test.medium@shopify.com to create medium-risk recommendations

- shopify.test.low@shopify.com to create low-risk recommendations

To simulate a risk level, the order must have a total value greater than zero. You must also have the Shopify Payments gateway in test mode to create test orders that simulate risk level. If you use another payment gateway for your test, then your store must be on the Shopify plan or higher.